In today’s digital era, financial transactions have undergone a significant transformation, making sending and receiving money instantly easier than ever.

Cash App, a popular peer-to-peer payment service, has emerged as a game-changer in this domain, empowering millions of users to manage their finances conveniently.

While Cash App is widely recognized for its seamless money transfer capabilities, did you know there are ways to get free money on Cash App? Yes, you heard it right! By employing a few simple strategies, you can tap into a world of possibilities and add extra cash to your wallet.

In this blog post, we will explore the various methods to get free money on Cash App, ensuring you make the most of this powerful financial tool.

So, let’s delve into the world of Cash App and discover the secrets to unlocking financial rewards.

Key Takeaways

- Cash App is a mobile payment app that lets users send and receive money, pay bills, and invest in stocks.

- Taking surveys, participating in social media contests, investing in stocks, referring friends, and using Cash Boost for unique discounts are all ways to earn free money on Cash App.

- Signing up for Cash App will earn you $5 to supplement your profits while claiming your free money on the app will get you an instant $10.

- Users can earn money by referring friends and family to the Cash App Referral Program.

- Users should link their bank account before using Cash App, add money to their Cash App account, and become acquainted with the app’s features and security standards.

Table of Contents

What Is Cash App?

Cash App is a smartphone-based payment application that allows users to send and receive money. It was developed by Square, a financial technology company founded by Jack Dorsey, the co-founder and CEO of Twitter.

Cash App offers a convenient and easy-to-use platform for individuals to transfer funds to friends, family, or other users.

The primary purpose of Cash App is to enable peer-to-peer (P2P) payments. Users can link their bank accounts or debit cards to the app and then use it to send money to others instantly.

The app also provides a unique username called a “$cashtag,” which allows users to send and receive funds by simply entering the recipient’s cashtag instead of their account or card details.

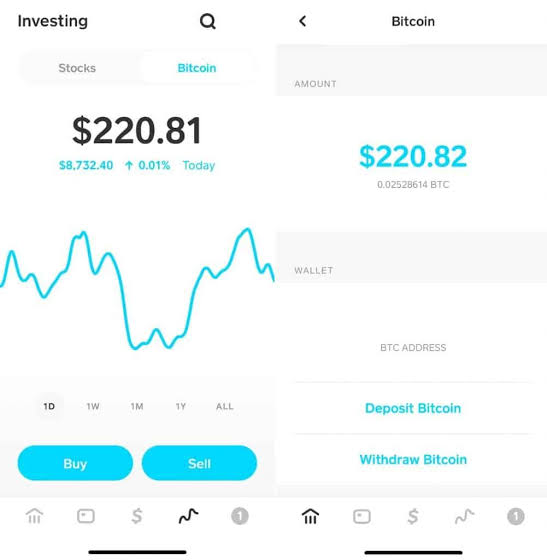

In addition to P2P payments, Cash App offers various features and services. Users can use the app to buy and sell Bitcoin, a popular cryptocurrency, providing them with an additional investment option.

Cash App also allows users to get a personalized Cash Card, a physical or virtual Visa debit card linked to their Cash App balance and used for online and in-store purchases.

Cash App provides security features such as PIN protection and two-factor authentication to help protect users’ accounts. However, users should still exercise caution and follow best practices for online transactions.

Cash App has become a popular mobile payment service, offering a simple and accessible way for individuals to send and receive money, make purchases, and even invest in cryptocurrency. Its ease of use and additional features have contributed to its widespread adoption among users looking for a convenient digital payment solution.

It would interest you to go through How to Make Money With My Phone Without Investment | 20 Best Ways

How Does Cash App Work?

Cash App is a mobile payment application that allows customers to send and receive money using smartphones. Here’s a general overview of how Cash App works:

1. Setting Up an Account

To use Cash App, you need to download the app from the App Store or Google Play Store and create an account. You’ll need to provide your mobile phone number or email address and create a unique username known as a “$Cashtag.”

2. Linking a Payment Method

After creating an account, you can link a debit card, credit card, or bank account to your Cash App. This allows you to add funds to your Cash App account or withdraw money.

3. Sending Money

You need to know their $Cashtag, phone number, or email address to send money to someone. Open the app, enter the desired amount, and select the recipient.

You can also add a note to specify the purpose of the payment. Once confirmed, the funds will be instantly transferred from your Cash App balance or linked payment method to the recipient’s Cash App account.

4. Receiving Money

You’ll receive a notification when someone sends you money through Cash App. The funds will be added to your Cash App balance, and you can choose to keep the money in your Cash App account or transfer it to your linked bank account.

5. Cash Card

The Cash Card is a real debit card offered by Cash App. It is linked to your Cash App account and allows you to purchase using the funds available in your Cash App balance. You can use the Cash Card anywhere that accepts traditional debit cards.

6. Bitcoin Transactions

Cash App also allows users to buy, sell, and store Bitcoin within the app. You can use your Cash App balance to purchase or sell Bitcoin and convert it into cash.

7. Additional Features

Cash App offers other features such as the ability to invest in stocks and buy fractional shares, direct deposit for receiving paychecks, and Cash Boost, which provides discounts for selected merchants.

Pros and Cons of Cash App

Cash App, developed by Square, is a popular mobile payment service that allows users to send and receive money quickly and easily.

Like any other financial service, Cash App has its pros and cons. Here are some of the advantages and disadvantages of using Cash App.

Pros of Cash App

1. Ease of use

Cash App has a user-friendly interface that makes it easy for anyone, even those unfamiliar with mobile payments, to send and receive money.

2. Quick transfers

Cash App enables instant money transfers between users. This feature is particularly useful when you need to send money urgently.

3. Free basic services

Cash App offers free person-to-person money transfers, meaning you can send money to friends and family without incurring fees.

4. Cash Card

Cash App provides users with a customizable Visa debit card called the Cash Card. It allows you to purchase using your Cash App balance, providing more flexibility and convenience.

5. Investing options

Cash App offers a feature called Cash App Investing, which allows users to invest in stocks and Bitcoin directly from the app. This feature can be appealing to those interested in simple investment options.

Cons of Cash App

1. Limited Availability

Cash App is primarily available in the United States and the United Kingdom. If you reside outside these countries, you may be unable to access or use the app.

2. Customer Support

Cash App has faced criticism for its customer support system. Some users have reported difficulties in reaching support representatives or experiencing delayed responses to their inquiries.

3. Fees for Certain Transactions

While basic person-to-person transfers are free, Cash App charges fees for certain services, such as instant transfers or using a credit card to add funds to your account. It’s essential to know the applicable fees before using these services.

4. Security Concerns

Cash App is not immune to security risks like any online payment service. There have been reports of scams and fraudulent activities targeting Cash App users. It’s crucial to remain vigilant and take precautions to protect your account.

5. Limited functionality

While Cash App offers various convenient features, it may not provide the same breadth of services as traditional banking institutions. Cash App may not meet all your needs if you require complex financial services like joint accounts or business banking.

Also read about The Rise of E-commerce: Starting Your Online Store in Nigeria

10 Best Methods To Get Free Money on Cash App

While there are legitimate ways to earn money or receive funds through various platforms, it’s important to clarify that seeking free money through illicit means or exploiting loopholes is illegal and unethical. Like any other financial platform, Cash App has measures to prevent fraudulent activities.

However, there are legal and legitimate ways to leverage Cash App and other similar platforms to earn or receive funds potentially. Here are some strategies you can explore:

1. Cash Back Rewards

Cash App offers a Cash Boost feature that allows you to earn cashback rewards when you use your Cash Card (a debit card linked to your Cash App account) for purchases at selected merchants. These rewards can help you save money on your regular expenses.

2. Referral Program

Cash App has a referral program where you can invite friends to join the app using your unique referral code or link. When your friends sign up and make a qualifying transaction, you and your friend can earn a bonus.

Sharing your referral code with friends and family or on social media can increase your referral bonus chances.

3. Participate in Surveys and Offers

Some legitimate online platforms offer paid surveys and offers. You can sign up for these platforms and complete surveys or complete certain tasks to earn money or gift cards.

Once you accumulate funds or gift cards, you can transfer them to your Cash App account.

4. Cash App Giveaways

Cash App or its affiliated partners occasionally run promotional campaigns or giveaways on social media platforms like Twitter or Instagram.

These giveaways usually require participants to follow certain instructions, retweet or share posts, or engage in a social media interaction.

While winning these giveaways is not guaranteed, participating in them can offer a chance to receive free money or prizes.

5. Crowdfunding

Cash App allows users to create and share fundraising campaigns for personal causes or charitable purposes.

You can leverage the platform to create a campaign for a legitimate cause you’re passionate about and share it with your network. People who resonate with your cause may choose to donate money to support your campaign.

6. Cash Boost

Cash Boost is a feature in the Cash App that offers discounts or cashback on eligible purchases. It provides a range of Boosts that can be applied to specific merchants or categories, such as restaurants, coffee shops, or grocery stores.

By selecting a Boost before purchasing, you can save money or earn cash back on those transactions.

7. Utilizing Bitcoin Boost

Bitcoin Boost is a unique function provided by Cash App that allows users to earn Bitcoin incentives when using their Cash Card to make transactions.

You can receive a percentage of your purchase back in Bitcoin by enabling the Bitcoin Boost, which will be added to your Cash App Bitcoin balance. This function not only saves money for customers but also introduces them to the world of cryptocurrencies.

8. Cash App Sign-up Bonus

A Cash App sign-up bonus is a promotional offer that gives new users a cash incentive when they sign up and make their first qualified purchase. This incentive encourages new users to try the site and appreciate its benefits.

9. Receive Reimbursement for ATM Fees

Cash App offers its customers a one-of-a-kind benefit by reimbursing ATM fees when they use their Cash Card to withdraw money. This function allows consumers to save money on fees banks or ATM operators charge.

10. Investing with Cash App

Cash App provides a straightforward and easy-to-use platform for consumers to invest in stocks and Bitcoin directly from the app. This feature allows users to easily and conveniently access investment options, even if they are new to investing.

How to Withdraw Your Cash App Earnings

Withdrawing your earnings from the Cash App is a straightforward process that allows you to access the money you’ve accumulated on the platform. Cash App is a popular peer-to-peer payment app that enables users to send and receive money and make purchases and investments.

Here’s a comprehensive guide on how to withdraw your Cash App earnings:

1. Link a Bank Account

- Open the Cash App on your mobile device and sign in to your account.

- Tap on the “Balance” tab at the screen’s bottom center.

- Press the “Cash Out” option, depicted by a dollar sign and an arrow pointing out.

- You will be prompted to link a bank account or debit card. Select the “Add Bank” option.

- Enter your bank account information as directed on the screen. Cash App will validate the information supplied.

2. Cash Out Money

- After successfully linking your bank account, return to the “Balance” tab.

- Enter the amount you want to cash out from your Cash App balance.

- Tap on the “Cash Out” button to initiate the withdrawal process.

- You may be required to enter your Cash App PIN or use biometric authentication (such as a fingerprint or face ID) for security purposes.

- Cash App will process the withdrawal and transfer the money to your linked bank account.

3. Instant Deposit (Optional)

- Cash App offers an Instant Deposit feature that allows you to transfer funds from your Cash App balance to your bank account instantly.

- However, Instant Deposits come with a fee of 1.5% of the total amount being transferred.

- If you choose to use Instant Deposit, you can follow the abovementioned steps but select the “Instant” option instead of the “Standard” option when cashing out.

4. Cash Card Withdrawal

- Cash App also provides users with a physical Cash Card, a Visa debit card linked to their Cash App balance.

- You can use this card to withdraw cash from ATMs or purchase wherever Visa is accepted.

- Find an ATM that accepts Visa cards to withdraw money using your Cash Card.

- Insert your Cash Card into the ATM and follow the instructions on the screen to complete the withdrawal.

5. Additional Tips

- Ensure you have sufficient funds in your Cash App balance before withdrawing.

- Remember that there might be daily, weekly, or monthly limits on how much you can withdraw from the Cash App. Check the app or contact Cash App customer support for information on your specific limits.

- If you encounter any issues or have questions regarding the withdrawal process, it’s recommended to contact Cash App support for assistance.

It’s important to note that fees may be associated with certain transactions, such as Instant Deposits or ATM withdrawals using the Cash Card. It’s advisable to review Cash App’s terms and conditions or consult their customer support for details on fees and any other relevant information.

Remember to prioritize the security of your Cash App account by regularly updating your password, enabling security features like two-factor authentication, and being cautious of potential scams or fraudulent activities.

Cash App Scams to Avoid

It’s important to be aware of various scams that target Cash App users. While Cash App itself is a legitimate platform, scammers may try to exploit it for their gain. Here are some common Cash App scams to avoid:

1. Cash Flipping Scams

Scammers may claim that if you send them a certain amount of money via Cash App, they will multiply it and send it back to you. These are typically pyramid schemes or outright scams, and you’ll likely lose your money.

2. Fake Customer Support Scams

Scammers may create fake customer support accounts or websites posing as Cash App representatives.

They may contact you via email, social media, or even phone, asking for your account details, password, or personal information. Cash App does not have a publicly available customer support phone number, so be cautious of anyone claiming to be from Cash App support.

3. Prize or Lottery Scams

Scammers may contact you, claiming that you have won a prize or lottery and need to send a payment through Cash App to claim it. Legitimate lotteries or contests will never ask you to pay to receive your winnings.

4. Phishing Scams

Be cautious of emails or text messages that appear to be from Cash App, asking you to click on a link and provide your login credentials or personal information. These messages may look convincing, but they are often attempts to steal your account details.

5. Overpayment Scams

Avoid overpayment scams if you’re selling goods or services online, and a buyer insists on paying through Cash App.

The scammer may send you a larger payment than the agreed-upon amount and then ask you to refund the excess. Eventually, their initial payment will be reversed or found fraudulent, and you’ll be out of the refund you sent.

How To Protect Yourself from These Scams

- Offers that look too good to be true should be avoided.

- Verify any communication directly through the official Cash App website or app.

- Avoid sharing personal information or login credentials with anyone you don’t trust.

- Make two-factor authentication available for your Cash App account.

- Report any suspicious activity or scams to Cash App support.

Remember, it’s essential to stay vigilant and cautious when using any online financial service, including Cash App.

Cash App Fees

Cash App is a popular mobile payment service that allows users to send and receive money and make purchases and investments. While the app’s basic functionality is free, certain fees are associated with specific transactions and services.

Here are some key points about Cash App fees:

1. Sending and Receiving Money

Cash App allows users to send and receive money from other users for free.

However, if you use a credit card to fund the payment, there is a 3% fee. Additionally, if you receive a payment using the Cash App and want to transfer the funds to your bank account instantly, Cash App charges a fee of 1.5% of the transfer amount.

2. Cash Out

When you want to transfer money from your Cash App balance to your linked bank account, Cash App offers two options. Standard deposits are free of charge and typically take 1-3 business days to process.

However, if you need the funds to be transferred instantly, Cash App provides an option called “Instant Deposit,” which incurs a fee of 1.5% of the transfer amount.

3. Bitcoin Transactions

Users of the Cash App can purchase, sell, and send Bitcoin within the app. When purchasing Bitcoin through Cash App, the platform may charge a fee that varies based on market conditions and other factors. These fees are disclosed at the time of the transaction.

4. Cash Card Transactions

Cash App offers a free customizable Visa debit card called the Cash Card. When using the Cash Card for purchases, there are no additional fees. However, if you use the Cash Card to withdraw money from an ATM, ATM fees may be charged by the ATM operator.

5. Business Transactions

Cash App also provides services for company accounts, which are called Cash App for the company. Business transactions may incur additional fees, which can vary depending on the nature of the transaction and the specific features used.

It’s important to note that fees and terms may change over time, so reviewing the most up-to-date information on the Cash App website or within the app itself is always a good idea. It’s also recommended to carefully read the terms and conditions of any financial transaction to understand any potential fees that may apply fully.

Some Popular Cash App Alternatives

Several popular alternatives to Cash App offer similar features for sending and receiving money and additional services. Here are some popular alternatives:

1. Venmo

Venmo is a widely used peer-to-peer payment app that allows users to send and receive money from friends and family. It offers a social aspect where you can add comments and emojis to your transactions.

2. PayPal

PayPal is one of the most well-known online payment platforms. It allows users to send and receive money, make online purchases, and transfer funds to their bank accounts. PayPal also offers a range of additional services for businesses.

3. Zelle

Zelle is a digital payment network that lets users send money directly to another person’s bank account. It’s often integrated into banking apps, making it convenient for users with participating banks.

4. Google Pay

Google Pay allows users to send and receive money, pay bills, and purchase online or in-store. It’s available on Android and iOS devices and integrates with other Google services.

5. Apple Pay

Apple Pay is a mobile payment and digital wallet service available on Apple devices. Users can send and receive money through iMessage, purchase in stores and apps, and transfer money to their bank accounts.

6. Square

Square offers various services, including the Cash App, which allows users to send and receive money. Square also provides business payment processing solutions, making it a versatile option.

7. Facebook Pay

Facebook Pay is a feature within the Facebook app that enables users to send money to friends, make in-app purchases, and donate to fundraisers. It’s available on Facebook, Messenger, and Instagram.

Conclusion

In conclusion, while getting free money on Cash App may be enticing, it’s essential to approach such claims with caution and skepticism. The online world is filled with scams and fraudulent activities, and protecting your personal information and financial security is crucial.

Cash App itself does not offer a legitimate method to obtain free money. Any promises or offers that suggest otherwise are likely scams to exploit unsuspecting users. Being wary of websites, apps, or individuals promising easy money or requesting your personal information or payment details is important.

Remember, no “free money” exists without legitimate effort or risk. If an opportunity appears too good to be true, it most likely is. Stay informed, exercise caution, and prioritize your financial well-being to maximize your resources.

Frequently Asked Questions

Can I get free money on a Cash App?

Yes, you can get free money on Cash App, but not by magic. There are several ways to earn free money on Cash App, such as cashback offers, referral programs, and surveys.

How can I earn cash back on a Cash App?

Cash App offers cash back on various purchases made using your linked card. You must activate the offer, make the purchase, and receive the cash back within a few days.

Are there any surveys available on Cash App?

Yes, Cash App offers surveys from time to time. Completing these surveys can earn you some free money.

Can I get free money by using Cash Boost?

Yes, Cash Boost offers discounts and cashback on various purchases. If you use Cash Boost on eligible purchases, you can save money.

Is there any catch to getting free money on Cash App?

While there is no catch, you must try to earn free money on Cash App. Whether completing surveys or making qualifying purchases, you must follow the terms and conditions.

References

- How To Get Free Money on Cash App: 7 Fast and Legitimate Ways

- How to get free money on cash app instantly 2023 | Here Are 18 Best Ways