The emergence of online investment platforms has made investing in Nigeria more accessible.

Previously, many people could not access investment opportunities due to their lengthy processes and a requirement for a certain level of capital. However, the emergence of fintech startups has made it easier to access investment opportunities online through investment platforms.

These investment platforms offer diverse investment opportunities, including stocks, bonds, mutual funds, and real estate.

Whether you’re a seasoned investor or a beginner, these investment platforms provide an excellent starting point for investing in Nigeria.

In this article, we have provided the 10 best legit investment platforms available in Nigeria to consider in your investment journey.

Key Takeaways

- By utilizing these platforms, Nigerians can actively pursue wealth accumulation and establish a secure financial foundation for themselves and their families.

- Various forms of investment platforms exist, such as online brokerage platforms, robo-advisors, peer-to-peer lending platforms, and cryptocurrency.

- Always conduct thorough research, diversify your investments, and stay informed about market trends and developments to enhance your investment journey.

Table of Contents

What Are Online Investment Platforms?

Online investment platforms are also known as online brokerages or investment apps.

They are digital platforms that allow individuals to buy, sell, and manage various types of investments, such as stocks, bonds, mutual funds, exchange-traded funds (ETFs), and more, through the Internet.

These platforms provide users with access to the financial markets and investment opportunities without the need for traditional brick-and-mortar brokerage firms.

Various forms of investment platforms exist, such as online brokerage platforms, robo-advisors, peer-to-peer lending platforms, cryptocurrency exchanges, and real estate crowdfunding platforms.

Each platform type serves different investment needs and strategies, providing a variety of features, fees, and support services.

Investors should determine the appropriate investment platforms based on their goals, preferences, risk tolerance, and desired level of involvement in managing their investments.

Investment platforms provide convenient and accessible ways for individuals to participate in financial markets and grow their wealth through investing.

However, users should be aware of the potential risks and fees associated with investing, as well as the importance of conducting thorough research before investing in investment platforms.

How Investment Platforms Typically Work (features):

1. Account Setup: New users create an account on online investment platforms by providing personal information and funding their account with money.

2. Investment Selection: Once the account is set up and funded, users can browse through the platform’s various investment options. These may include stocks, bonds, mutual funds, ETFs, and sometimes alternative investments like real estate investment trusts (REITs) or cryptocurrencies.

3. Research and Analysis: Many online investment platforms offer research tools, educational resources, and analysis to help users make informed investment decisions. Users can then access company financials, analyst ratings, news articles, and other relevant information to evaluate investment opportunities.

4. Trading options: Users can place buy or sell orders for investments directly through the platform’s interface. They can also specify the number of shares or units they want to buy or sell, along with the price at which they wish to execute the trade.

5. Portfolio Management: Online investment platforms often provide portfolio management tools and features that allow users to track the performance of their investments over time. Using this feature, users can monitor their portfolio’s asset allocation, diversification, and overall returns.

6. Account Maintenance: Users can manage their account settings, update personal information, deposit or withdraw funds, and access statements and tax documents through the online platform.

7. Customer Support Features: Most online investment platforms offer customer support services to assist users with account-related inquiries, technical issues, and investment questions.

10 Investment Options Available in Nigeria

With its abundant natural resources, growing population, and thriving economy, Nigeria presents diverse investment opportunities.

These several investment options are available for Nigerians and foreigners seeking to invest in the Nigerian market.

Some of the investment options available include the following:

1. Bonds and Stock

Bonds and stocks are two primary forms of investment instruments in the financial markets. Bonds represent debt securities that governments, municipalities, or corporations use to raise capital. When an investor purchases a bond, they are lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity.

On the other hand, stocks, also known as equities, represent ownership stakes in publicly traded companies. When individuals buy stocks, they become shareholders and are entitled to a portion of the company’s profits and voting rights in certain corporate decisions.

2. Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. Mutual funds also provide liquidity, as investors can buy or sell shares on any business day at the fund’s current net asset value (NAV). Mutual funds are a convenient and low-cost way for investors to diversify their portfolios and potentially achieve their financial goals.

3. Foreign Exchange, known as Forex

Forex trading entails exchanging various currencies within a market. It is renowned for its status as one of the most dynamic trading markets.

4. Cryptocurrency and Blockchain Investments

Despite its volatility, cryptocurrency investment is increasingly popular in Nigeria. Some Nigerians are embracing the risk of investing in cryptocurrencies such as Bitcoin and Ethereum because of their potential for high returns.

5. Real Estate

Investing in real estate entails buying, owning, renting, or selling property for financial gain. Real estate refers to physical assets such as land and permanent structures. Given Nigeria’s expanding population, real estate presents an opportunity for profitable investment.

6. Treasury Bills

The Central Bank administers government-issued short-term investment tools known as Treasury bills to provide the government with immediate funding. These bills are considered secure as they benefit from the government’s complete guarantee. They have a maturity period ranging from 91 days to 364 days, with interest paid upfront.

7. ETFs

ETFs, or exchange-traded funds, are investment funds that are traded on stock exchanges, much like individual stocks. They typically hold assets such as stocks, bonds, or commodities, and aim to track the performance of a specific index. ETFs provide investors with a way to diversify their portfolios and gain exposure to a wide range of assets with relatively low costs and minimal effort.

8. Agriculture Investments

Investing in the agriculture sector presents another attractive opportunity. Certain investment platforms enable you to finance a farm and, subsequently, receive back your capital plus a portion of the farm’s profits after a specified period. This practice not only enhances the agriculture sector but also generates profits for investors.

9. Bank Savings

Bank savings refer to depositing money into a bank account, such as a savings account, where it earns interest over time. Investors consider this form of investment relatively low-risk because the government typically insures the funds up to certain limits, providing a stable and secure way to save and grow money over time.

10. Fixed Deposits (FD)

Banks and financial institutions offer investment instruments known as fixed deposits (FD), also called time deposits or term deposits. In an FD, an investor deposits a certain amount of money with the bank for a fixed period, known as the maturity period. During this time, the money earns a predetermined rate of interest, which is typically higher than that of a regular savings account.

Fixed deposit (FD) investments are considered low-risk because banks guarantee the principal amount and fix the interest rate, making them a popular choice for conservative investors seeking stable returns over a specific period.

Read also: 25+ top online investment platforms that pays daily

How to Determine Legit Investment Platforms

To determine whether an investment platform is legitimate, you must conduct thorough research and consider several factors.

Some of these factors have been listed below:

- Check if the investment platform is registered with relevant regulatory authorities, such as the Securities and Exchange Commission (SEC) in the United States, the Securities and Exchange Commission in Nigeria, or the Financial Conduct Authority (FCA) in the UK. Registration indicates that the platform operates within legal guidelines and complies with regulatory requirements. In

- Research the background and reputation of the investment platform by reading reviews, testimonials, and articles from reputable sources. Look for any history of regulatory actions, lawsuits, or fraudulent activities associated with the platform.

- Legitimate investment platforms provide clear and transparent information about their services, fees, investment products, and terms of use. Be wary of platforms that lack transparency or provide vague or misleading information.

- Ensure investment platforms employ robust security measures to protect users’ personal and financial information. Look for features such as encryption, multi-factor authentication, and secure socket layer (SSL) technology that safeguard users against cyber threats and unauthorized access.

- Legitimate investment platforms offer responsive and reliable customer support to address users’ inquiries, concerns, and issues in time. To determine if an investment platform is legit, test the platform’s customer support channels, such as email, phone, or live chat, to assess their responsiveness and effectiveness.

- Evaluate the investment offerings available on the platform to ensure they are legitimate and suitable for your investment goals and risk tolerance. Be cautious of platforms that promote high-risk or speculative investments with unrealistic returns.

- Pay attention to user feedback and reviews from other investors who have used the platform. Positive feedback from satisfied users can provide reassurance about the platform’s legitimacy and reliability.

- Stay vigilant for red flags like unsolicited investment offers, high-pressure sales tactics, promises of guaranteed returns, and requests for sensitive personal or financial information.

By carefully assessing these factors and conducting due diligence, you can better determine whether an investment platform is legitimate and trustworthy.

If you have any doubts or concerns, it’s advisable to seek advice from a financial professional before investing your money in any of the investment platforms provided below.

The Function of the Securities and Exchange Commission (SEC)

The Securities and Exchange Commission (SEC) in Nigeria plays a crucial role in overseeing and developing the capital markets. It regulates various financial entities, such as banks and asset management companies, ensuring their compliance with strict rules.

Additionally, the SEC is responsible for registering and regulating securities portfolios used in investment apps, which enhances investor confidence and fosters market stability.

To protect investments and build trust, the SEC mandates that investment platforms adhere to guidelines promoting transparency and fairness.

As investors interact with these apps, the SEC oversees robust insurance and wealth management practices, establishing trust and reducing the risks associated with digital platforms.

10 Legit Investment Platforms in Nigeria

- PiggyVest

- CowryWise

- Trove

- Risevest

- Bamboo

- Pillowfund

- Chaka

- Carbon

- Payday Investor

- Quidax

1. PiggyVest

PiggyVest is an online investment platform that gives users a range of investment choices like stocks, mutual funds, and bonds. It is one of Nigeria’s leading savings and investment platforms. It has over 4 million subscribers using the services of the app.

It includes an auto-invest feature, enabling users to establish automatic investments to help them grow their wealth over time.

This platform enables you to allocate funds for particular objectives, engage in diverse investment options such as mutual funds and real estate, and accrue interest on your savings.

Piggyvest’s in-app feature, Investify, gives you access to investment options, and you can start investing safely with as little as N5,000 and build your savings over time. It also has a dollar wallet that helps you save in dollars for a while.

2. Cowrywise

Cowrywise is a prominent digital-first platform for managing wealth targeted towards the younger generation in Nigeria and across Africa. Their goal is to make savings and investment products more accessible and easier to understand for everyone.

Cowrywise offers a diverse selection of mutual funds in Nigeria and provides different savings choices, including regular savings, emergency savings, halal savings, savings circles, and Money Duo.

Additionally, their investment options include both Naira and dollar mutual funds.

In addition to its financial services, Cowrywise is recognized as a leading authority on financial education in Nigeria.

3. Trove

Trove is a digital investment platform based in Nigeria that facilitates investments in both local and international stocks and shares. With a minimum investment of N1000, users can access a wide range of investment options, including stocks, bonds, ETFs, and other securities in the market.

Trove provides the flexibility to invest in either naira or US dollars, with a diverse selection of over 4000 stocks available for investment.

The platform provides various financial management resources, including tools for budgeting and setting savings targets.

4. Risevest

Risevest functions as a digital investment platform and manages dollar assets, offering access to various foreign investment options. These opportunities include products such as fixed income, US real estate, and US stocks. By using Risevest, individuals can grow and manage their money effectively, as the platform acts as a fund manager, providing guidance and support in making investment decisions.

This investment platform is creating an impact in the industry and the opportunity for international investing. With this platform, you can expand your investment portfolio globally by investing in various types of assets.

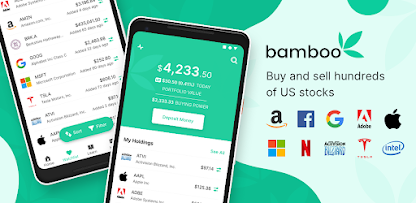

5. Bamboo

Bamboo is a Nigerian investment platform that offers the opportunity for global investing. Users can purchase US stocks, ETFs, and other assets in US dollars. A prominent aspect of the platform is the ability to engage in fractional investing, allowing users to invest in fractions of shares.

Additionally, Bamboo provides a user-friendly mobile app for easy access to investment opportunities. The platform prioritizes security by implementing KYC compliance and encryption safeguards to protect users’ information and investments.

6. Pillowfund

Pillow Fund is an innovative digital application designed to assist users in accumulating savings in dollar-denominated assets. By utilizing the Pillow Fund platform, individuals can securely save in dollars while being assured of a 14% annual return on their investment.

In addition to dollar savings, Pillow Fund offers opportunities to invest in stablecoins, Ethereum, and Bitcoin. As a platform committed to customer satisfaction, Pillow Fund provides daily interest to its clients, setting itself apart as a reliable and beneficial financial tool for users seeking to grow their wealth.

7. Chaka

Chaka is a licensed investment app in Nigeria that facilitates trading in both local and foreign stocks. It is available for individuals and companies, offering investment opportunities and wealth management services.

The application operates under full SEC regulation, ensuring users a safe environment for participating in investment endeavors. Chaka allows users to easily buy and sell stocks, ETFs, and other securities from the Nigerian and US stock exchanges. The app provides access to investment opportunities, allowing users to diversify their portfolios and potentially earn on their investments.

Chaka also offers features such as real-time market data, investment research, and secure transactions, making it a convenient and reliable platform for both new and experienced investors in Nigeria.

8. Carbon

Carbon provides a variety of investment and personal finance options. You can even begin investing with as little as N100 using the app. Returns on investments on the app can go up to 16%. Also, investment durations can be customized from 3 to 12 months.

9. Payday Investor

The Payday Investor platform simplifies and secures setting money aside to increase investment profits over time. It offers services such as financial goal-based investments, group goal-based investments, direct debit investments, and more, allowing users to easily invest their money through the application weekly or monthly at their own will.

10. Quidax

Quidax is a cryptocurrency exchange platform based in Nigeria. It allows users to buy, sell, and trade cryptocurrencies, including popular ones like Bitcoin, Ethereum, Ripple, etc.

Quidax aims to provide a secure and user-friendly platform for individuals to engage in transactions.

Read also: Is Turo Profitable? Is Buying a Turo a Good Investment This Year?

How to Sign up on an Investment Platform

Registering on investment platforms usually includes a simple process. You would start by creating an account with your personal information, such as your name, email address, and password. Then, you may need to verify your identity by providing additional documents, like a driver’s license or passport.

Once your account is set up, you can start exploring investment options and funding your account to begin investing

Remember that each platform may have specific steps for signing up, but the process is generally straightforward.

Step 1: Choose a Platform

Consider choosing an online investment platform that best fits your investment objectives, preferences, and familiarity with investing. Consider fees, available investment options, user interface, customer service, and security features.

Step 2: Create an Account

Visit the website or download the mobile app of the chosen investment platform. Look for a “Sign Up” or “Create Account” button and click on it to begin the registration process.

Step 3: Provide Personal Information

Fill out the registration form with your details, including your full name, email address, date of birth, residential address, and sometimes your social security number or other identification information. This information is necessary for verifying your identity and complying with regulatory requirements.

Step 4: Verification of Your Identity

Some investment platforms may require you to verify your identity by providing additional documentation, such as a copy of your driver’s license, passport, or other government-issued ID. Follow the instructions provided by investment platforms to complete the identity verification process.

Step 5: Funding Your Account

Once your account is created and verified, fund it with money to start investing. Most investment platforms offer multiple funding options, such as bank transfers, credit/debit card payments, electronic funds transfers (EFT), or wire transfers. Choose the best method for you and follow the instructions to deposit funds into your account.

Step 6: Choose an Investment Option

After funding your account, explore the investment options available on the platform, such as stocks, bonds, mutual funds, ETFs, and more. Take your time to research and select investments that align with your financial goals, risk tolerance, and investment strategy.

Step 7: Start Investing

Once you’ve chosen your investments, you can place buy-in orders directly through the platform’s interface. Specify the number of shares or units you want to purchase and the price at which you wish to execute the trade. Check your order carefully before submitting it.

Step 8: Monitor and Manage Your Investments

Keep track of your investments’ performance and adjust your portfolio over time. Many investment platforms offer portfolio management tools, performance tracking, and research resources to help you make informed investment decisions.

With these steps, you can sign up on investment platforms and start investing in the financial markets available.

Always conduct thorough research, diversify your investments, and stay informed about market trends and developments to enhance your investment journey.

Conclusion

In conclusion, Nigeria offers abundant opportunities for individuals seeking to strengthen their financial position. Through these 10 reputable investment platforms, individuals can assert control over their financial destiny and make well-informed choices regarding where to allocate their funds.

Whether real estate, stocks, agriculture, or peer-to-peer lending, these are tailored to suit diverse investor preferences.

By utilizing these platforms, Nigerians can actively pursue wealth accumulation and establish a secure financial foundation for themselves and their families. It’s crucial to conduct thorough research and seek professional guidance before committing to any investment decisions.

However, with a strategic approach, these investment platforms can serve as potent instruments for financial empowerment.

FAQs

Are investment platforms in Nigeria regulated?

Yes, reputable investment platforms in Nigeria are regulated by relevant government agencies such as the Securities and Exchange Commission (SEC) or other financial regulatory bodies.

Are these investment platforms suitable for beginners?

Yes, many of these platforms offer user-friendly interfaces, educational resources, and guidance to help beginners navigate the investment process effectively.

What are the risks associated with investing through these platforms?

Investing always carries inherent risks, including the risk of losing money. It’s essential to understand the risks associated with each investment product and to diversify your investments to manage risk effectively.

References

- https://nairacompare.ng -top-investment-apps-in-nigeria-2024

- https://stow.ng -top-investment-opportunities-in-nigeria

- https://cowrywise.com -investment-apps-in-nigeria

- https://blog.transferxo.com -top-legit-investment-companies-in-nigeria

What a fantastic resource! The articles are meticulously crafted, offering a perfect balance of depth and accessibility. I always walk away having gained new understanding. My sincere appreciation to the team behind this outstanding website.

What a fantastic resource! The articles are meticulously crafted, offering a perfect balance of depth and accessibility. I always walk away having gained new understanding. My sincere appreciation to the team behind this outstanding website.

The breadth of knowledge compiled on this website is astounding. Every article is a well-crafted masterpiece brimming with insights. I’m grateful to have discovered such a rich educational resource. You’ve gained a lifelong fan!